Empower and Quicken are two of the most popular financial platforms available today. Both offer very profound wherever applications for budgeting as well as for personal finance management. And while Quicken is pretty weak regarding investment features, in the case of Empower, this structure is practically its core.

Which of the two is the better one? It depends on what you’re looking for. While Quicken, no shadow of a doubt, is the most robust budgeting platform, Quicken and other Functional capabilities you added in the Empower. However, that all-important component of investment remains there. And as it should be the other way in respect of financial management as such, it’s not a lesser benefit in favor of Empower.

CONTENTS AVAILABLE AT THIS PAGE

- 1 Quick Compare Features of Empower and Quicken

- 2 What is Empower?

- 3 Empower Free Version Features

- 4 About Empower Wealth Management

- 5 What is Quicken?

- 6 Quicken Investment Features

- 7 Pricing Compare

- 8 Customer Service

- 9 Accessibility of Empower and Quicken

- 9.1 Final Thought:

- 9.2 FAQs:

- 9.3 Q: What is the primary reason for the existence of Empower?

- 9.4 Q: Does Quicken allow for budgeting?

- 9.5 Q: Are the free variants of Empower and Quicken products available?

- 9.6 Q: Is it possible to use Empower and Quicken on smartphones and tablets?

- 9.7 Q: Which types of customer support do Empower and Quicken have?

Quick Compare Features of Empower and Quicken

| Feature | Empower | Quicken |

|---|---|---|

| Review Rating | 9.5/10 | 9.2/10 |

| Investment Tracking | √ | √ |

| Budgeting | √ | √ |

| Retirement Planner | √ | √ |

| Net Worth Tracker | √ | X |

| Bill Tracker | √ | √ |

| Bill Pay | X | √ |

| Reconcile Transactions | X | √ |

| Track the Market Value of Your Home | √ | √ |

| Free Credit Score | X | √ |

| Promotions | Free | 10% off the first year |

| Synchronization | Link to any U.S. Based financial account | Able to sync with more than 14,500 financial institutions |

| Accessibility | Desktop, tablet, iOS, and Android mobile devices | Desktop, tablet, iOS, and Android mobile devices |

| Customer Service | 24/7 contact by phone or email | Live chat available |

| Pricing | Free | $35.99 to $103.99/year |

What is Empower?

Empower is an online platform for individual financial management that assists clients in planning and controlling their finances. The aim is to allow individuals to track their spending and investing activity, and their savings, and plan for their future retirement. Some of these include budgeting, managing investments, retirement planning, tracking net worth, and paying bills.

The service was formerly branded Personal Capital and tries to make financial management easier by connecting financial accounts and viewing the entire financial picture in one place. The services of Empower are mostly free of charge, but there is also a service for users with a large portfolio in the form of Wealth Management services.

Empower Free Version Features

The free version of Empower (Personal Capital) is quite sophisticated and comes with sufficient features aimed at enabling users to easily manage their finances. Below are the key features available in the free version of Empower:

Empower Free Version Features:

The free version of Empower is ideal for people who are looking for an overview of their finances and the means to manage investments, budgets, and savings effectively.

About Empower Wealth Management

One of the premium services offered by Empower (earlier Personal Capital) is the provision of Wealth Management Services that professionally manage significant portfolios on behalf of members. Clients are assigned trusted and appointed financial experts who assist them depending on their personal goals, appetite for risk, and other long-range decisions they need to make.

Along with a specified long-term investment objective, the investment strategy aims at the maximum efficient tax management, and diversification of the client’s portfolio and its growth through timely rebalanced changes in the asset structure.

Additionally, Empower Wealth Management has advanced inclusive financial planning that encompasses retirement, estate, legacy, and tax-efficient investment plans to achieve maximal returns. Users also benefit from the use of Empower’s features which include tracking budgets, future retirements, and other investments that come with management.

The service is availed to customers with at least $100,000 available for investment with the fees commencing at 0.89% of the assets managed on behalf of the clients. As a relief for high net-worth individuals and especially those looking to engage in a singular financial management strategy, Empower’s advisors use fiduciary standards when advising the client’s interests.

What is Quicken?

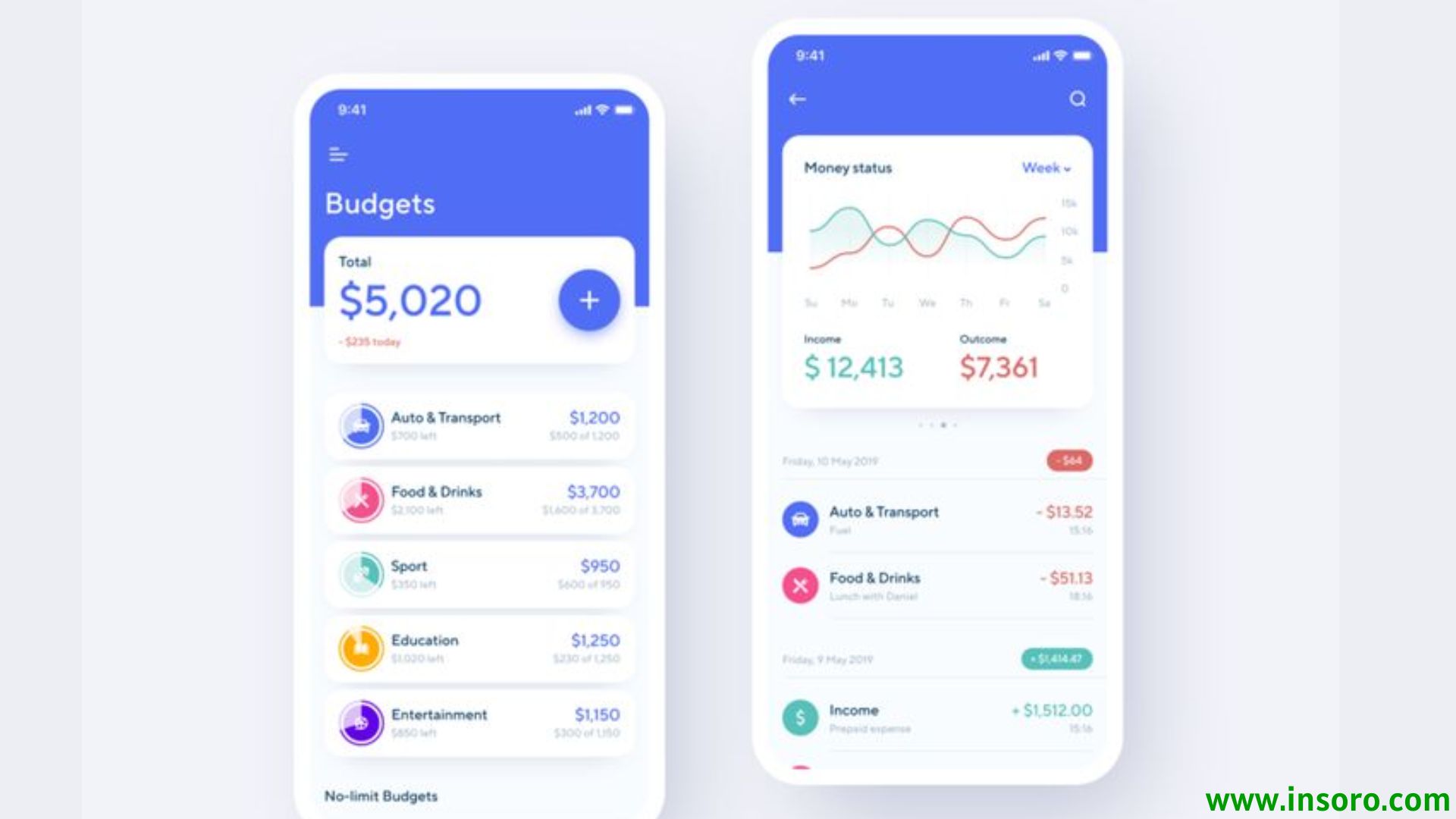

Quicken is a personal finance application software that is the most popular of them all, assisting people in harmonizing their finances. Basic tools included are budgeting, checking one’s spending habits, and even paying bills as users can combine their banking, credit cards, loans, and stock accounts to provide a picture of net economic worth. This enables better management of monthly expenses and budgeting as Quicken provides features that track daily expenses to help users keep to their defined financial limits. It also comes with portable apps for ios and Android devices for easier retrieval of financial information anytime and anywhere.

As for the investment features, Quicken enables its clients to evaluate their portfolios, assess the performance of their investments, and measure the asset base. This feature provides an update to investors of where their money has been invested and how much return they are going to receive from that investment as well as plan for future investments such as retirement. Apart from those features, Quicken also includes retirement planning which estimates clients’ saving needs over time depending on how much they are currently earning and their expenditures. Its ability to import more than 14500 financial institutions ensures correct information is available across to all accounts and keeps everything current and in one spot.

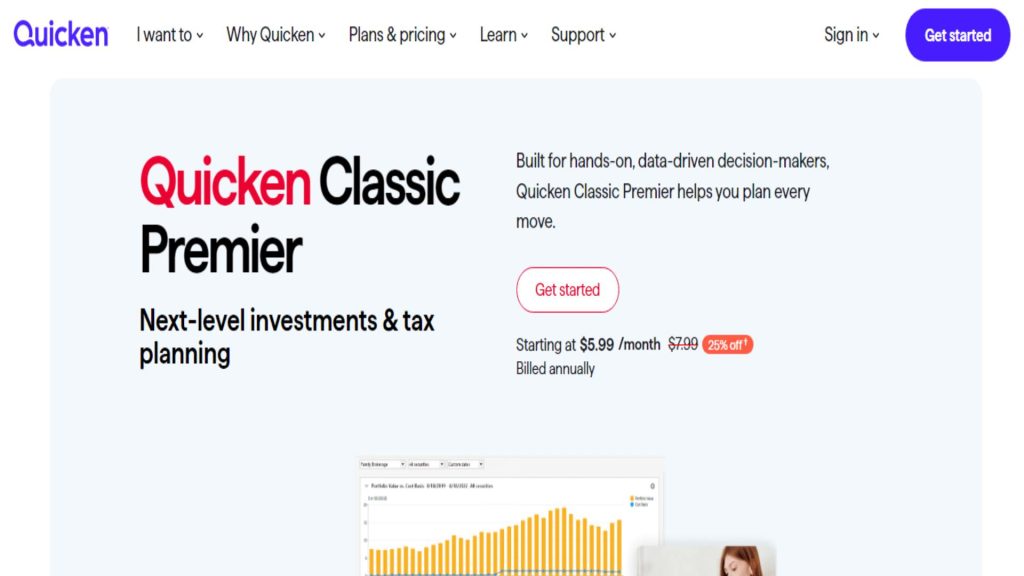

Depending on the edition, Quicken also provides newer features such as bill payment, credit score tracking and property management. These activities appeal to people with more sophisticated arms around money, for instance small business owners or real estate developer. Quicken is a subscription-based service: different pricing plans are dependent on the level of service availed to the subscriber. It aims to perfect the solutions of the potential and actual users so that they do not have to switch software tools for different financial tasks and save some time for dealing with more important issues in their financial wellbeing.

Related Read:- Top 10 Finance Blogs in India 2024: Your Guide to the Best Financial Resources

Quicken Investment Features

Quicken includes additional functionalities such as investment tools that allow users to follow, analyze, and manage their portfolios. These tools are appealing to a first-time investor and also people wanting to keep a close eye on their investments. Here are Quicken investment features:

The investment aspects enable Quicken to be very useful to those clients who wish to make long-term financial investment plans and follow and manage their investment initiatives within the desired time frame.

Pricing Compare

| Feature | Empower | Quicken |

|---|---|---|

| Free Financial Software | Yes, Empower’s financial software is free and used by 1.6 million people. | No free version; annual subscription fee based on selected product. |

| Wealth Management Fee Structure | – First $1M: 0.89% – First $3M (Private clients): 0.79% – Next $2M: 0.69% – Next $5M: 0.59% – Over $10M: 0.49% | Pricing based on product: – Simplifi: $47.99/year – Starter: $35.99/year – Deluxe: $46.79/year ($51.99 after first year) – Premier: $70.19/year ($77.99 after first year) – Home & Business: $93.59/year ($103.99 after first year) |

| Managed Assets | Fees apply to assets under management (AUM) – excludes 401(k) funds unless managed separately. | No wealth management services provided, only personal finance and investment tracking tools. |

| Money-Back Guarantee | Not applicable. | 30-day money back guarantee. |

| Ability to Switch Plans | Not available. | Yes, users can switch plans within the 30-day trial period if dissatisfied. |

| Best Feature | Free financial dashboard and comprehensive wealth management for high-net-worth clients. | Affordable personal finance management with several pricing tiers, including budgeting, bill management, and investment tracking. |

Customer Service

Empower has solid customer service – particularly for its Wealth Management clients. People who subscribe to the premium services of Empower are assigned financial advisors who guide them in a personalized manner regarding investments and other financial needs. This type of service is ideal for investors who are dealing with their portfolios and their plans, and so want their advice. As for clients of Empower Wealth Management, they have to of course have advisors who can be reached by phone or email as well so there is always contact with the clients’ persons. Also, users of Empower’s free financial software can obtain limited assistance over the Internet, email, or telephone.

However, in contrast, Quicken offers customer support live chat, telephone support, and online support. Any of Quicken’s paid plans allow the subscribers to get help from the customer support team at given working hours. Quicken further comes with an innovative online support system within the product including articles, common questions and answers, common problems, and solutions guides. Then depending on the subscription plan, a sport of more advanced support is present where so that premium issues can be handled easily without much time before the users or any other person gets the answers that they need for the computer or financial management. Both Seekinghelp and Quicken have the same objective of offering assistance to users but the difference lies in the fact that Empower is more involved in the financial service while Quicken is more focused on the technical assistance and customer service.

Accessibility of Empower and Quicken

The financial software provided by Empower is made easily available across many devices such as desktop, tablet, and mobile devices be it on iOS or Android. Users can budget, make investments, and do financial planning from anywhere making it favorable for busy people. The tools and features in Empower’s platform help to enhance usability, allowing all users to navigate around with ease and not face any difficulties in operating it.

Quicken also makes sure that its services are accessible to the people as it extends its reach to different platforms. Quicken software can be used on computers, tablets, and even mobile devices such as iPhones and Android which accommodates the user in practicing their finances. The mobile application for Quicken enhances the capabilities of the computer platform whereby users settle their expenses and budget or invest without the need for a computer. Training users and maximizing the cloud features are also some challenges faced by Quicken, users are allowed to work from any device and retrieve their information online using the cloud. The two access levels are similar in that both address the dimension of accessibility to the user’s requirements in managing their finances.

Related Read:- 5 Simple Ways to Keep a Stress-Free Budget

Final Thought:

In their distinct domains, both Empower and Quicken can be regarded as topmost in finance platforms. Empower provides the greatest resource in portfolio performance and management for users intending to invest and retire ideally. It is very easy to sign up for the program as it has its primary features for saving, spending, and investing free of charge, and basic insights to the money management tools.

Quicken excels in the areas of creating budgets and tracking expenses keeping the users who love to have control over their spending satisfied. It is packed with tools that enable it to function effectively for day-to-day spending, bill commitments any feasible plan making and so many other options therefore making it rather a perfect financial management software for people who do not have the time to go for various options. In the end, it is the individual investment objectives that determine which combination of tools — whether improvements in the investment solution or efficient management of the budget will be chosen. By identifying the core features offered by each service, customers will be able to make decisions that fit their parameters and objectives economically.

FAQs:

Q: What is the primary reason for the existence of Empower?

Empower is to a large extent designed to render such services as wealth management and investment tracking, assist clients in developing a financial plan, tracking their investments, and planning for retirement.

Q: Does Quicken allow for budgeting?

Yes, assuming that budgeting is important; there are built-in budgeting and expense tracking tools that enable users to control their spending and achieve certain expenditure goals.

Q: Are the free variants of Empower and Quicken products available?

Yes, there is a free financial dashboard displayed on Empower but lacks the free version of Quicken, although there is a 30-day refund policy for any subscribed plans taken out.

Q: Is it possible to use Empower and Quicken on smartphones and tablets?

Both Empower and Quicken are available in desktop laptops as well as Tablets and Mobile phones –OS: iOS & Android at any time at any place.

Q: Which types of customer support do Empower and Quicken have?

Empower has phone and email support for its users who especially are Wealth Management clients whereas on the other hand Quicken has live chat and phone support for all its users.